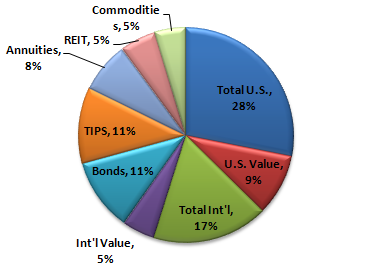

After I had decided on the basics of our asset allocation, there were stilll some further choices to be made. First, within the 60% we were allocating to equities, those stocks can be divided into domestic and international funds. Diversifying outside the bounds of the U.S. shields our portfolio from the risk of having all the eggs in one basket. If the U.S/international split was based purely on market capitalization, it would be close to 50/50. But with my American exceptionalism hat on, I decided to weight the U.S. at 60% of the total stock allocation, leaving 40% for international.

Further, since past data (which provides no guarantee of future behavior!) shows that stocks of small companies, particularly those that are undervalued vs. their inherent value, perform a bit better than the overall market. So out of the U.S. and international pie slices, a small bit of each is reserved for indices which track small capitalization, under-valued companies.

Finally, within the bond portion of the asset pie, I split half and half between a fund tracking the full bond market, and one that includes inflation protection (TIPS). TIPS provide a lower rate of return than normal bonds, but since the return is guaranteed to be on top of inflation, they provide additional diversification and protection.

Now, all of that adds up to quite a few pie slices. I didn’t quite round the numbers exactly, but the following chart shows the general idea.

Next, the difficult portion was to find funds available in the various retirement accounts that my wife and I had accumulated. They all had different lists of available funds, so it took quite a while to work everything out. I use a modified version of an Excel spreadsheet from the Bogleheads site to check how everything adds up. When there were multiple options for a given asset type, I chose the fund with the lowest operating expense, which usually ended up being either Vanguard or Fidelity Spartan funds.

All told, we ended up with 18 different funds. Crazy, I know! That’s what we get for having nine different accounts with three different firms! At the moment, 12 of the 18 constitute less than about 5% of our total each.

So there it is. Most of the information I’ve read recommends rebalancing no more than maybe twice a year. Rebalancing is the process of comparing your current asset allocation against your target and then shifting funds to bring yourself back into alignment. You don’t want to do it too often, or you lose out on investment gains. But do it too sparingly and you don’t get as much risk protections from the diversification.

Too many numbers. I know myself to be a spreadsheet junkie, so it was somewhat enjoyable. But now I get the benefit of knowing that our retirement funds are balanced against risk and that I don’t have to bother to check the market very often. Our target asset allocation is set, and we’ll ride this for at least five years or so, when it may be time to adjust the percentages due to age.