When I got married last year, one of the inevitable chores was consolidating financial accounts. As it turns out, my wife and I have similar approaches to budgeting and saving, so our discussions about family spending was relatively easy. However, the shear number of accounts that the two of us held required a good bit of shuffling and closing. We each held checking accounts with both online banks and local banks, primarily in order to have a non-zero interest rate while still retaining access to local ATMs. In addition, because of vagaries with our employers, together we had close to 10 retirement accounts.

After working through the relatively easy task of choosing which bank accounts to keep and which to merge, I was left looking at the bulk of our retirement savings (which was not a lot of money itself, just a lot of accounts) and wondering how to have a coherent management approach.

So after doing some reading, I finally figured out that what I was working on was Asset Allocation. There is no shortage of information, ranging from short definitions and somewhat abstract explanations to straight-forward steps. The best overall description probably comes from the Bogleheads site.

I checked out a few books from the library and found Larry Swedloe’s book on investment strategy to be rather informative. That book was one of the primary ones that convinced me to actually put some thought into which stocks and mutual funds we were choosing as investments with our limited retirement savings.

I found a series of posts from the blog, My Money Blog, to be extremely helpful. Ultimately, I decided to get out of the stock-picking game and move completely to passive investing when our savings went into a number of index funds, rather than actively-managed mutual funds. I wish I could go back to the 25-year self and tell him to stop thinking he was smarter than the rest of the people picking stocks and just invest in index funds instead. Even with the low market returns from the past decade, I think I would still come out better with indexing than picking.

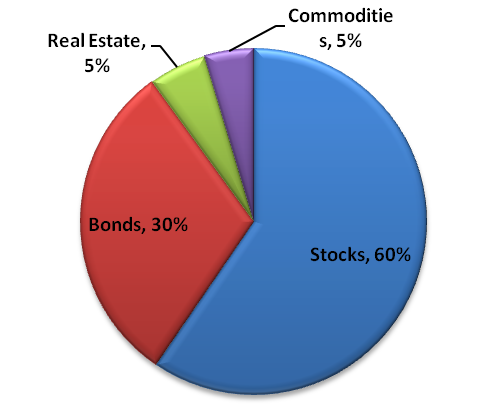

The first decision was how much of the portfolio should go to bonds vs. stocks. I ended up going with 30% bonds, but in hindsight, I’m beginning to think that might be a bit too conservative, given the fact that I’m 36 and my wife is a good bit younger. In any event, here’s how our allocation looks.

The two smaller wedges are for commodities and real estate. In our retirement accounts, we have access to a fund that invests in real estate as well as an ETF for commodities. And based on the theory of using different asset classes to reduce risk, I decided to stick 5% in both.

More later about applying a comprehensive portfolio allocation among all of our retirement accounts. I’m a numbers junkie and getting to mess around with Excel has been fun. it’s not like we’re Bill Gates and shifting millions of dollars around, but with our employers contributing to our retirement, we need to make wise decisions about how to plan for our eventual hazy days of retirement!

(I’m writing this post largely because I’ve gained so much knowledge from many of the financial bloggers out there. I wanted to contribute a small bit of feedback.)